- U.S. multifamily property rents declined less than those of office and industrial properties during the 2001 economic recession and their growth rate was considerably higher post-recession.

- During the 2008-2009 recession, multifamily rents were more resilient than those of office, industrial and retail.

- Multifamily rents have outperformed those of the other major property sectors during and after the 2008-2009 recession in three ways. The sector experienced the lowest level of rent decline, the fastest recovery to pre-recession peaks and the longest post-recession period of rent growth.

Multifamily Outperformed in Past Recessions

Analyzing the past two recessions’ impact on commercial real estate performance is very useful for understanding the likely dynamics of the next recession and its effect on real estate.

While each recession has unique impacts on how businesses and people use commercial real estate, there are some common characteristics.

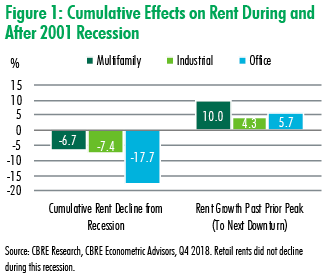

Based on CBRE Research’s analysis of effective rent change during and after the past two recessions, multifamily outperformed office and industrial in the 2001 recession and all major property sectors (office, industrial, retail) during the 2008-2009 recession. Multifamily generally had lower total rent decline and more rapid post-recession rent recovery.

For multifamily owners and investors, the prospect of a coming recession should offer pause, but not undue concern. Rent loss is likely, but for a limited period of time followed by a strong rebound.

2001 Recession

Compared with most recessions in U.S. history, the 2001 recession was relatively brief and shallow. Causing a GDP decline of less than 1%, this recession was a small price to pay for the end of the longest period of economic growth in U.S. history. Yet commercial real estate still felt its impact. Retail was the lone exception with no rent decline.

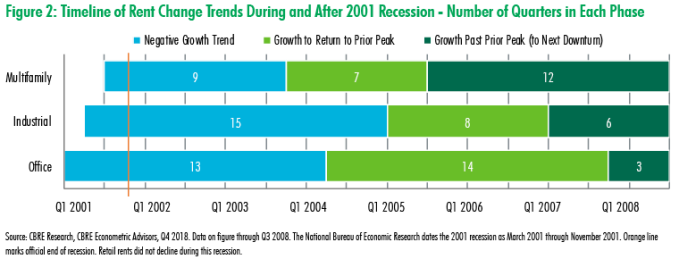

Multifamily rents reached a peak of $1,197 per unit in Q3 2001 and fell to $1,116 in Q4 2003. (Note that rents continued to fall even after the recession officially ended, a typical pattern for all commercial real estate.) Over that period of nine quarters, multifamily rents declined 6.7%. However, both office and industrial rents fared worse and their declines occurred over longer periods of time.

Office experienced a 17.7% total loss in effective rents over a 13-quarter period until finally returning to growth in mid-2004. It took another 14 quarters to reach the pre-recession peak rent.

The extended period of rent declines and reclamation only left three quarters of growth beyond the prior peak until the next recession was in full swing.

Industrial fared slightly better with a less severe rent decline (-7.4%). Only eight quarters were need for the sector to regain its prior peak rents, which left six quarters of growth beyond what was lost.

Multifamily had a shorter period of rent decline and a shorter time to reach prior peak rents. This left 12 quarters for rents to rise before the next recession.

Multifamily achieved 10% rent growth beyond prior peak. Industrial and office rents grew only 4.3% and 5.7%, respectively, beyond their prior peaks due to the extended time they required to mitigate their losses.

2008-2009 Recession

The 2008-2009 recession caused an almost unprecedented shift in commercial real estate demand. Multifamily fared far better than other property types from a rent perspective. It experienced a lower level of rent decline and a far shorter period between the trough of the cycle (Q4 2009) and the point at which sector rents reached the prior peak (Q3 2011).

The recession’s single-family housing collapse helped multifamily demand by moving households from homeownership to rentals (via foreclosures) and by diminishing the appeal of homeownership given falling home values.

Source: Multifamily Most Resilient Property Sector to Recessions | U.S. Multifamily Research Brief