South Johnson County Powers Local Office Gains; Investors Respond to Suburban Leasing Trends

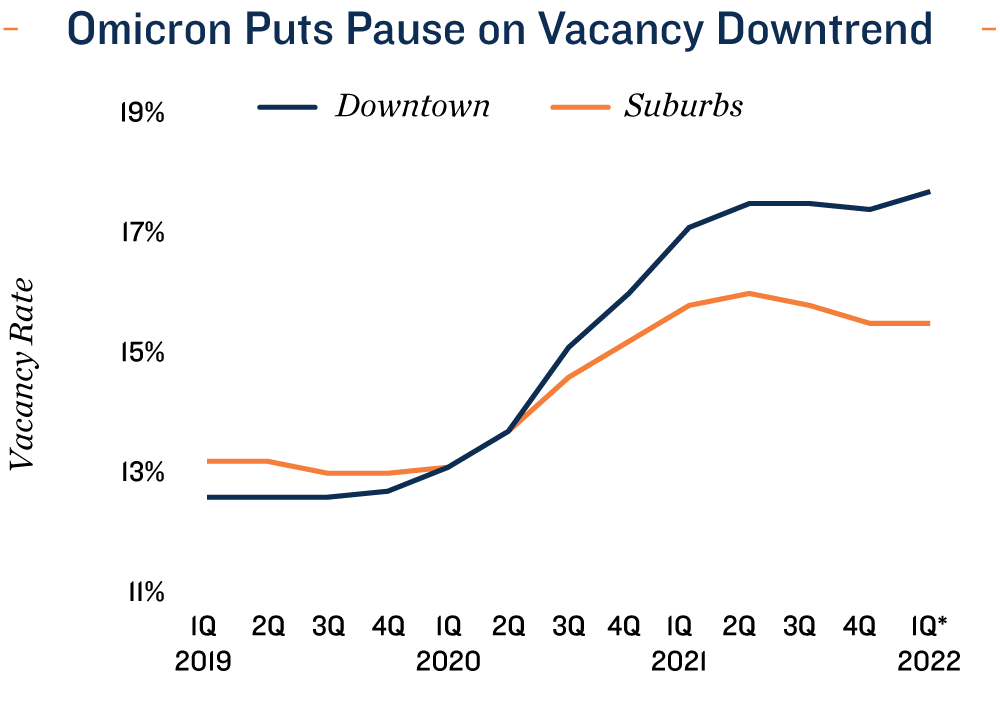

Absorption outside the CBD reflects growing demand for higher-end space. Kansas City’s office sector entered 2022 following a recent stint of encouraging performance. Across suburban submarkets, traditional office-using firms absorbed 1.2 million square feet during the third quarter of last year, for the strongest three-month total since 2007. Rising demand was preceded by the number of office-using positions surpassing the pre-pandemic peak. While the job count retreated in subsequent months, another round of gains is anticipated, led by growth in South Johnson County. Here, tech-related expansions and relocations are fueling demand for newer or renovated space. Last year, TreviPay and Industrial Accessories each inked midsize leases in Overland Park, with Optiv subleasing nearly 50,000 square feet in adjacent Leawood. Heightened demand for space in South Johnson County has the potential to spur a wave of project starts this year, as nearly 3 million square feet of space is proposed here. As the metro’s largest submarket by inventory, the area will significantly impact metrowide fundamentals with its positive performance this year, allowing overall absorption to exceed delivery volume.

Mid-tier trading dictates deal flow. Investors that focused on Midwest markets with proportionally high numbers of traditional office-using positions are pursuing listings in Kansas City. The metro’s ability to attract tech firms is expanding the local buyer pool, which largely consists of private investors that target sub-$5 million transactions. Smaller Class B properties in South Johnson and East Jackson counties account for the largest percentage of deal flow, with these buildings trading at high-4 to mid-5 percent minimum returns. In both locales, pricing below $200 per square foot is available for 1960s-to-1990s-vintage assets. Home to one of the lowest vacancy rates among major submarkets, Midtown also attracts investors seeking Class B assets. Future Kansas City Streetcar stops in the area have the potential to bolster the attractiveness of nearby offices.

2022 Market Forecast

Credit/Original Report: https://www.marcusmillichap.com/research/market-report/kansas-city/kansas-city-1q22-office-market-report