Big Tech Doubles Down on Space; Return to Office Approaching

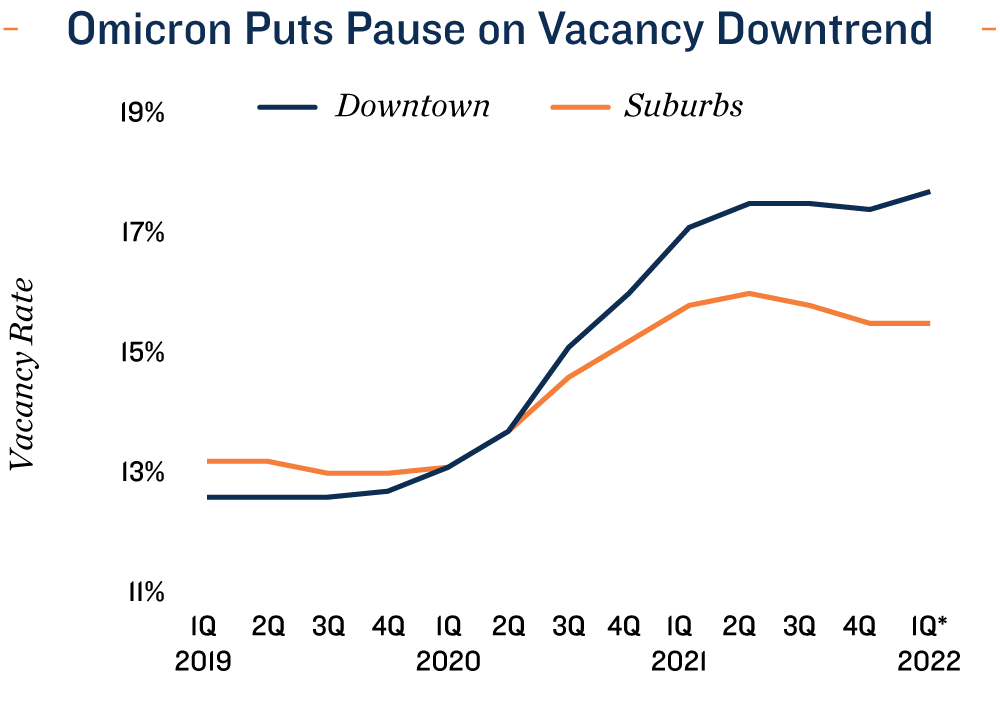

Omicron a minor setback, but attitudes are shifting. Before the omicron wave, office leasing activity had reached its highest levels since the onset of the pandemic. The space available for sublease also declined, most importantly in central business districts. Omicron interrupted this positive trend, raising vacancy in CBDs by an estimated 30 basis points in the first quarter of 2022, while suburban rates remained stable. The subsequent slowdown in cases is welcome news for office owners. If the U.S. does not face a new, serious pandemic wave, it is likely performance could reinitiate pre-omicron trends. Changes to gathering rules in prominent office markets, such as New York, Bay Area, Los Angeles and Seattle, also suggest more employees will return to offices, at least part time, soon, providing another tailwind for office demand.

Tech firms signal imminent return to workplace. The country’s largest technology companies have upped the sizes of their office campuses, suggesting physical spaces will be a key component of corporate strategy going forward. Since October, Meta, Facebook’s parent company, has added nearly 1.8 million square feet of space to its national inventory. Apple and Amazon each committed to over 1 million square feet over the course of 2021 as well. Google purchased St. John’s Terminal in Manhattan, with intentions to move in during 2023. March and April employee return dates have been signaled, with varying flexibility. Smaller firms will likely follow, resulting in heightened demand for office space.

Flight to quality underway. Leasing activity has been strongest for high-end office properties, even in metros most impacted by the pandemic, highlighting a tenant shift to quality assets within the market. Key factors driving the trend include employee health, energy cost reduction, and as a means of enticing workers back into offices. Firms have sought advanced air purification systems, green energy certifications and high levels of amenities to address these concerns. Class B/C office owners are remaining competitive through concessions and tenant-specific upgrades.

Labor Market Trends Aid Office Assets

Traditional office-using jobs gaining most quickly. Non-farm payrolls were approximately 1 percent below the pre-pandemic peak at the start of April, but office-using employment has grown. Job counts in the financial activities sector crossed the previous high in January 2022, joining the professional and business services sector, which currently sits more than 3 percent above its pre-2020 record. As a result, overall office-using employment is up roughly 2 percent nationally, compared to before the health crisis.

Sizable cohort of workers eager to resume in-person activities. According to the Pew Research Center, the number of workers without access to physical offices who report a willingness to return is rising, up to 49 percent in 2022, compared to the 36 percent registered in 2020. This suggests a large pool of employees will come back upon policy changes at the company level. At the same time, there’s a meaningful segment of employees that prefer to remain remote, as 61 percent of at-home workers indicate they choose to work outside the office when given the option.

* Estimate

Sources: Marcus & Millichap Research Services; The Pew Research Center; CoStar Group, Inc.